What’s Changing and Why It Matters

Background

On 24th October 2025, the Kenya Revenue Authority (KRA) issued a public notice announcing enhancements to the Tax Compliance Certificate (TCC) process. For many businesses, this might seem like just another compliance update — but this move signals a bigger policy shift: KRA is tightening the link between compliance behavior and taxpayercredibility.

⚙️ Why the Changes Were Introduced

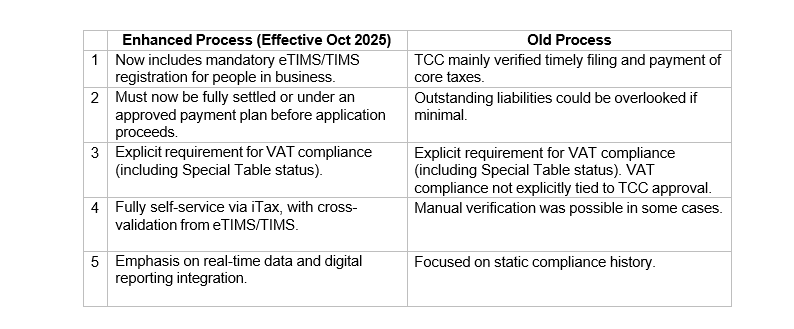

In recent years, KRA has been pursuing a more data-driven, real-time compliance framework. The rollout of eTIMS/TIMS for businesses was one of the biggest steps in this direction — enabling KRA to verify sales, issue electronic invoices, and match data across tax types (VAT, Income Tax, etc.).

However, the previous TCC process had gaps:

● Many taxpayers who weren’t registered on eTIMS could still obtain a TCC, even though they weren’t meeting transactional reporting obligations.

● Some businesses obtained a TCC while they had outstanding liabilities or unfiled returns, especially under manual reviews or delayed reconciliations.

● VAT non-compliance or delayed remittances often went unnoticed until audits.

By integrating eTIMS compliance and cross-tax validation into the TCC process, KRA aims

to:

● Ensure only fully compliant tax-payers access TCCs.

● Promote data integrity and transparency through system-linked verification.

● Discourage “event-based compliance” (i.e., taxpayers rushing to comply only when tendering or renewing contracts).

🆕 What’s New Compared to Before

🏢 What This Means for Businesses

● Access to business opportunities: Tenders, licensing, financing, partnerships often require a valid TCC. Non-compliance may exclude you.

● Increased compliance risk: It’s not enough to “just be generally compliant”; the KRA now expects you to tick all boxes.

● Digital readiness is key: If your entity hasn’t yet onboarded eTIMS/TIMS (where required) you may face delays.

● Cash-flow consideration: Payment of past liabilities or entering a payment plan may require budgeting and good planning.

● VAT focus: Some businesses may underestimate the importance of their VAT status or special-table obligations — now it’s a gate to the certificate.

💡 Aura & Co CPA’s Role: Your Compliance Partner

At AURA & CO, we see this as more than a regulatory tightening — it’s a moment for businesses to embed compliance efficiency into their operations.

Here’s how we help clients respond:

1. TCC Readiness Reviews – We conduct quick assessments to flag eTIMS gaps, late filings, or VAT inconsistencies before you apply.

2. Digital Compliance Setup – Assisting businesses to properly onboard onto eTIMS/TIMS and align internal invoicing systems.

3. Liability Reconciliation – Helping you review tax ledgers, clear historical issues, or set up structured payment plans.

4. Ongoing Compliance Monitoring – Monthly or quarterly reviews to ensure you remain “TCC-ready” all year round.

As compliance becomes increasingly system-driven, our advisory isn’t just about filing — it’s about future-proofing your business.

✳️ Tip of the Week

“Don’t wait for a tender deadline to discover your TCC isn’t approved.”

Conduct a pre-TCC audit this quarter — eTIMS registration, VAT status, filing timeliness, and outstanding liabilities — and correct any red flags early.