(e-RITS System for landlords, SMEs, and real-estate-linked businesses)

-

Why This Matters Now

-On 25 September 2025, the Kenya Revenue Authority (KRA) rolled out the Electronic Rental Income Tax System (e-RITS) — a new digital platform requiring property owners to declare and pay rental income tax monthly.

-But this isn’t just a new portal. It’s part of a bigger digital shift: the integration of KRA services into the eCitizen platform, where all government services — from business registrations to tax compliance are all now being centralized as part of their digitization of Government services plan.

-That now means that rental income tax is no longer just an isolated KRA affair. Your property records, compliance status, and rental tax payments will soon all be visible and connected across government systems, from county permits to business licenses.

-For landlords, property managers, and SMEs in the real estate or leasing sectors, this marks a new era of accountability — and opportunity — in Kenya’s tax ecosystem.

- What’s Changing — Key Developments

- Monthly filing & payment: e-RITS replaces the previous quarterly or ad-hoc filing systems. Rental income tax must now be filed and paid by the 20th of every month.

- Property & tenant registration: Landlords must record every property they own — including tenant names, locations, rent amounts, and lease details.

- Linked to eCitizen: e-RITS is now accessible through ecitizen.go.ke, meaning that landlords must now have eCitizen accounts linked to their KRA PINs to transact.

- Data integration: Property data in e-RITS feeds directly into KRA’s iTax and eCitizen ecosystems, allowing real-time visibility of tax compliance of those taxpayers.

- Automated computation: For individuals under the simplified regime, the system automatically applies the 5% rental income tax rate on gross rent. For corporates, the standard income tax rates then apply.

- Digital receipts and alerts: Once payments are made through eCitizen, taxpayers instantly receive digital receipts — and e-RITS flags the missed or under-declared months.

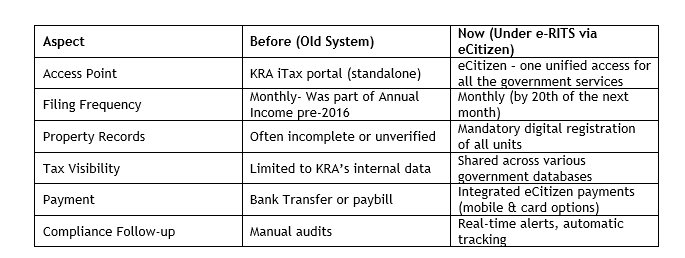

- Before vs. Now — The Shift Explained

Read also about Inside KRA’s New Employee Benefit Tax Rules: What Employers & SMEs Should Know

This shift reflects KRA’s broader mission — to seal revenue leaks in the rental sector, to enhance transparency, and to ensure improved ease of compliance through digitization of services.

- What This Means for Businesses and Property Owners

- Compliance is now public-facing: Because eCitizen is the gateway for all official services — including business registrations, land searches, and tax certificates — your rental tax compliance will now affect other government dealings.

- Cash flow planning is key: Monthly payments mean more regular cash obligations. Landlords and property managers must plan for rental tax deductions upfront.

- Automation is opportunity: SMEs in property management can now expand their value by offering compliance-as-a-service — handling monthly filings and updates for clients.

- Data consistency matters: Any mismatch between your iTax and eCitizen profiles (e.g., PIN, property ownership, or business registration) can trigger compliance flags.

- Integration across systems: Counties issuing business permits or land clearances may soon verify compliance directly via eCitizen — making FBT, PAYE, and rental tax part of your wider compliance footprint within the country’s fast evolving tax landscape.

- Aura & Co CPA Insight

At Aura & Co CPA, we view e-RITS as more than just another system — it’s a blueprint for Kenya’s next phase of digital tax administration.

While some may see it as a compliance burden, those who adapt early will find it easier to access tenders, property transfers, and financing — because your tax health will now speak for your business across government platforms.

We’re helping clients transition smoothly through:

✅ eCitizen linkage: Ensuring KRA PINs, business profiles, and property records are correctly linked.

✅ Onboarding & training: Guiding property owners through e-RITS setup and compliance workflows.

✅ Compliance health checks: Reviewing rental declarations for consistency before integration audits.

✅ Digital reporting automation: Helping SMEs use accounting tools to feed data directly into monthly filings.

In short: e-RITS isn’t just about paying rental tax — it’s about being visible, verifiable, and ready for Kenya’s connected compliance and digitized future.

Tax Tuesday Tip

-Take some time this week to log in to eCitizen → KRA → e-RITS.

-Confirm that your property and tenant details are updated, and your KRA PIN is correctly linked.

-A quick check now could save you costly compliance delays later — especially as Kenya’s digital systems continue to merge; and that’s where professional guidance streamlines matters for you.