Why This Matters Now

If you’re an employer in Kenya — even a small business — the way you offer “extras” to your workforce is no longer just an HR decision: it’s a tax liability.

The Kenya Revenue Authority (KRA) has tightened its approach to taxing fringe benefits and deemed interest — the hidden value in perks like low-interest staff loans, company cars, housing allowances, or director advances.

As of October 2025, KRA updated the prescribed market interest rate quarterly, setting it at 8% for the last quarter of 2025, marking a significant shift — turning employee benefit taxation into a continuous compliance requirement rather than a once-a-year adjustment.

These changes matter because they redefine how benefits are taxed and how employers must account for them — affecting both cash flow and compliance standing.

What’s Changing — Key Developments

- Quarterly updates are now standard: KRA will issue a new market interest rate every quarter. The current rate is 8% (Oct–Dec 2025). Any staff or related-party loans below this rate trigger tax under FBT or deemed interest rules.

- Wider coverage: The tax doesn’t just hit formal employee loans — even informal advances to directors, shareholders, or related entities can be caught under these rules.

- Employer pays, not employee: FBT is payable by the employer at the corporate tax rate (30%), calculated on the value of the benefit.

- Real-time visibility: Through iTax and digital payroll integrations, KRA can now detect undeclared employee benefits more easily — increasing audit risk for non-compliance.

- Stronger link to compliance: Missing FBT filings could affect your ability to obtain a Tax Compliance Certificate (TCC) – which is increasingly required for tenders, licenses, and financing.

Inside KRA’s New Employee Benefit Tax Rules: What Employers & SMEs Should Know

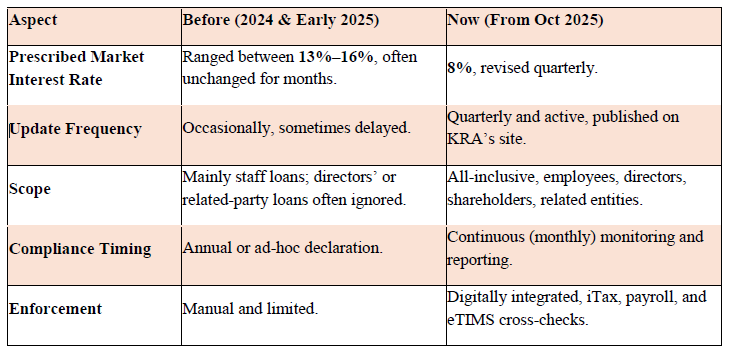

Before vs. Now; the Shift Explained

What used to be a quiet corner of payroll compliance is now a high-visibility audit zone.

What This Means for Businesses

- Loan policies need review: Lending below 8% now comes with a tax cost. Adjust your internal lending rates or redesign your staff loan program.

- Plan for cash flow impact: Since FBT is paid by the employer, even small benefit differences can add up over the year.

- Keep solid documentation: Ensure all employee loans, car benefits, and housing perks are properly recorded and valued.

- Integrate tax checks into payroll: Automate benefit tracking where possible — especially if you already use digital payroll or accounting systems.

- Protect your TCC status: Full benefit reporting is now part of the compliance story.

Aura & Co CPA Insight

At Aura & Co CPA, we view this as more than a rate change — it’s a signal of KRA’s digital shift toward real-time employer monitoring.

We help businesses:

- Run Benefit Health Checks to identify hidden FBT exposure.

- Create tax-efficient staff loan and allowance policies.

- Set up monthly compliance tracking for FBT and PAYE.

- Stay updated on every quarterly KRA rate revision.

With the right structure, you can still reward your team — just smarter, cleaner, and fully compliant.